Intelligent Benefits Platform for HR Departments, Brokers and Employees.

How to Prepare for ACA Compliance Reporting

By Christie Wright | Published | No Comments

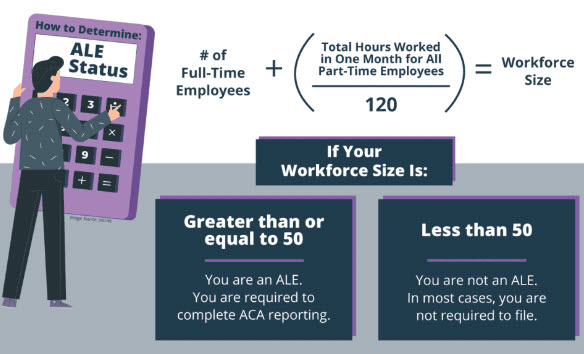

Applicable Large Employers (ALEs) are those who employed 50 or more full-time employees in the previous calendar year, and must also offer minimum essential coverage to at least 95% of their full-time employees or they will risk paying penalties according to the Affordable Care Act (ACA) Law. With that comes an employer mandate requiring employers to report specific information to the IRS about individuals offered/covered by a group health plan and must also provide a statement to those individuals.

If annual open enrollment wasn’t challenging enough to deal with, ACA filings are often very time consuming and daunting for HR departments that do not outsource their ACA filing needs. Some of the most common challenges employers can run up against:

- Determining the correct lookback period and assigning proper codes and amounts for Lines 14, 15, 16 on Form 1095C.

- Access to trained ACA support professionals or ACA reporting vendors that know what questions to ask to address your compliance needs.

- Electronically transmitting the 1094/1095 data to IRS, using their system and required filing formats.

Deadlines & Timelines for the 2023 tax year

The IRS will continue enforcing ACA responsibilities for timely filing and furnishing forms, so it’s vital that employers stay up-to-date on all the latest Affordable Care Act and Tax news. An added benefit is partnering with Benefitwerks, a trusted benefits administration vendor to handle all your ACA compliance and reporting needs.

- January 31, 2024 – Furnish Form 1095-C to Employees (CA residents only)

- March 1, 2024 – Furnish Form 1095-C to Employees

- March 31, 2024 – Electronic filing with IRS

Leave a Reply